Project Spotlight: Stock Price Forecasting with ML

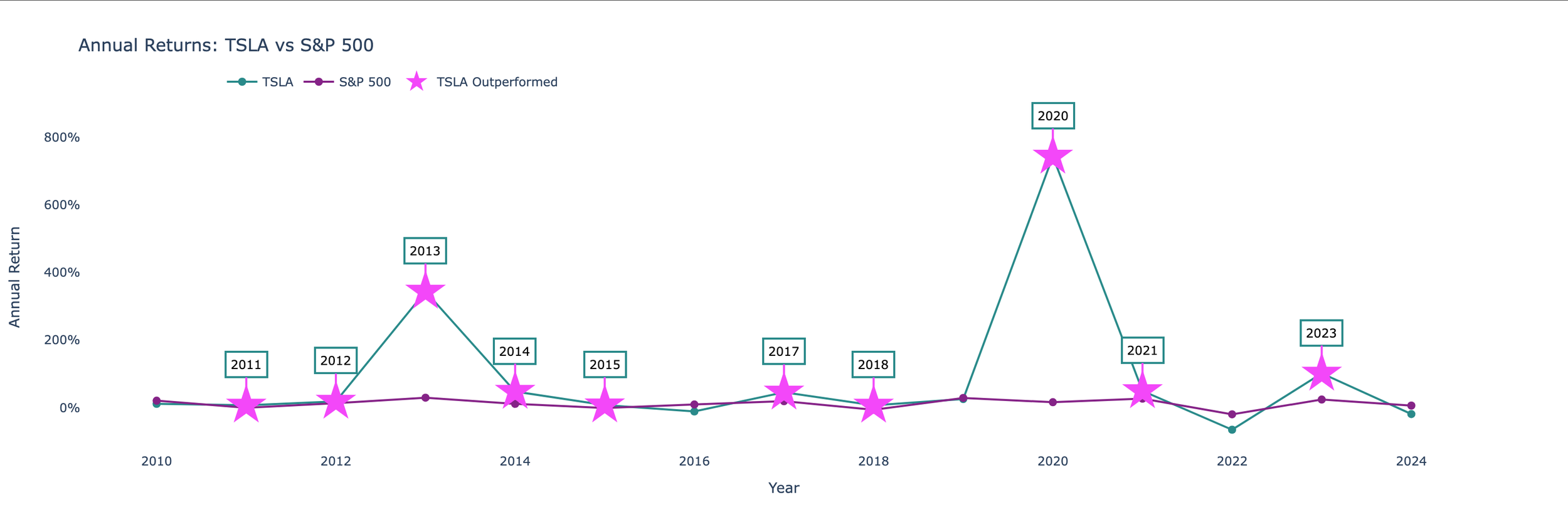

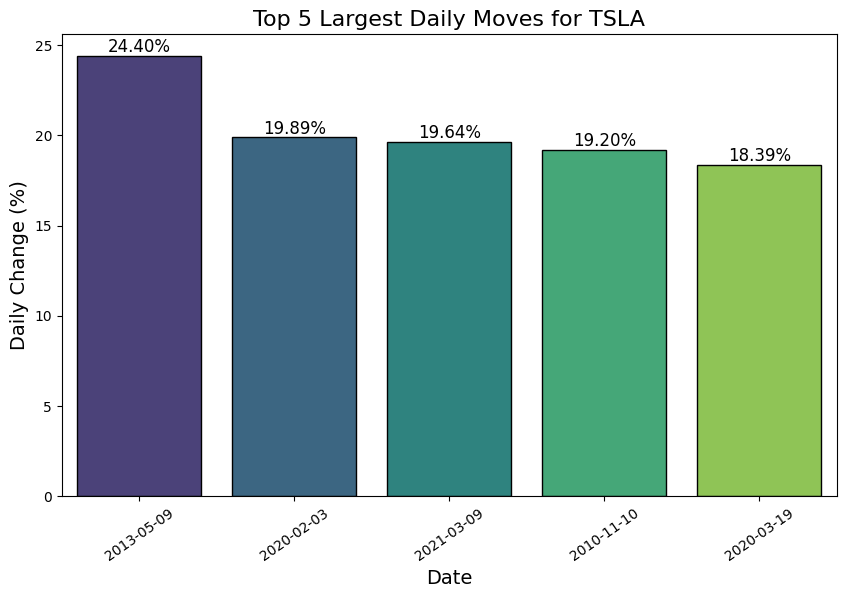

Employed advanced Python libraries to fetch and analyze historical stock data from Yahoo Finance, focusing on Tesla and its comparison with market benchmarks.

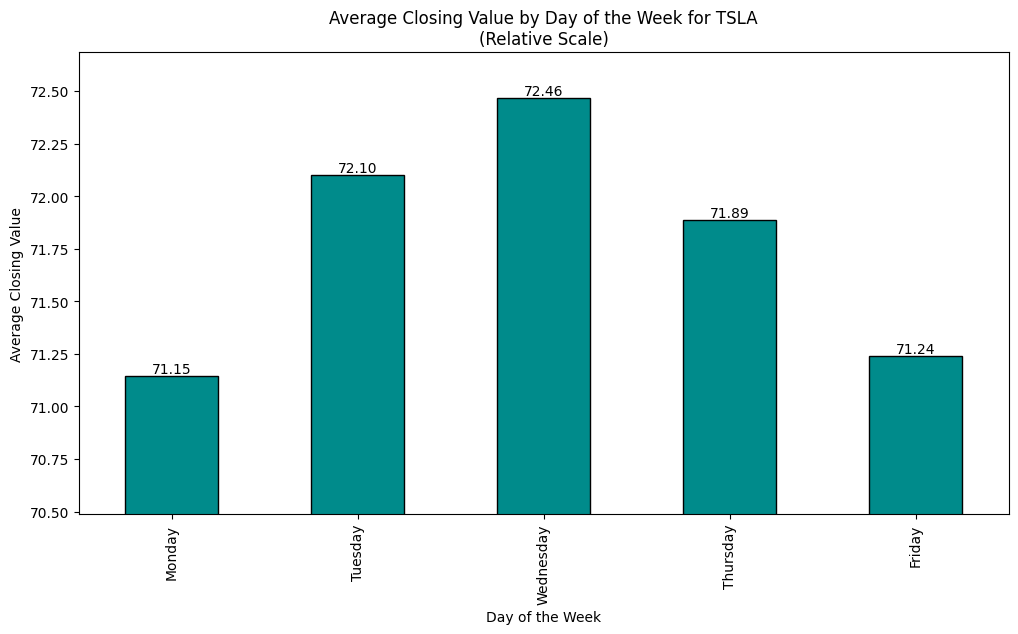

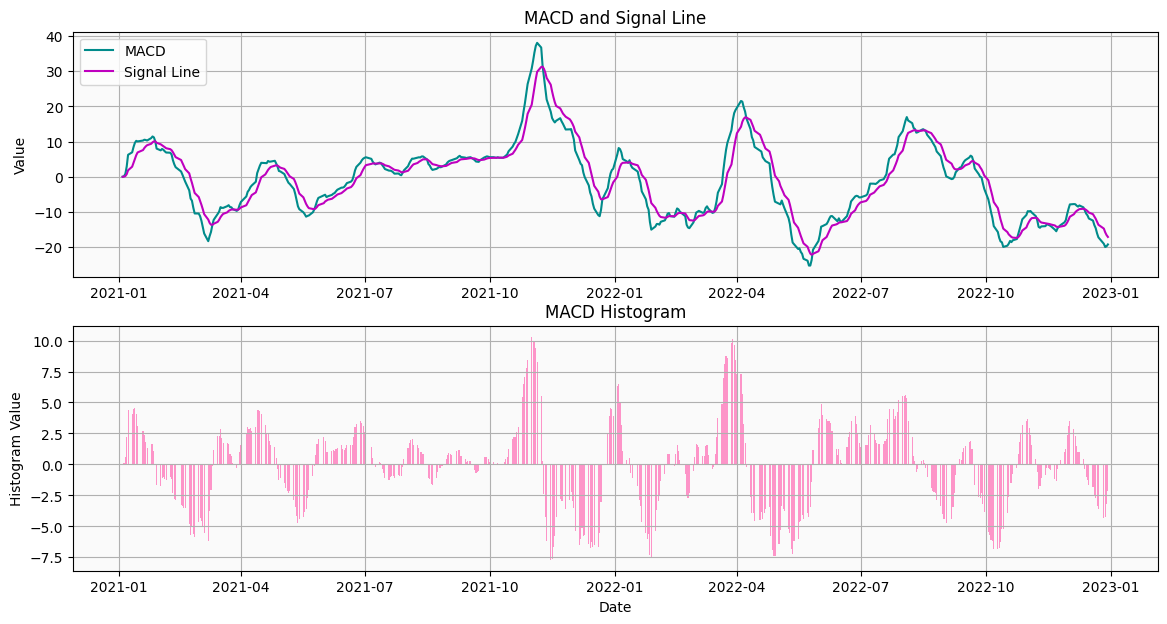

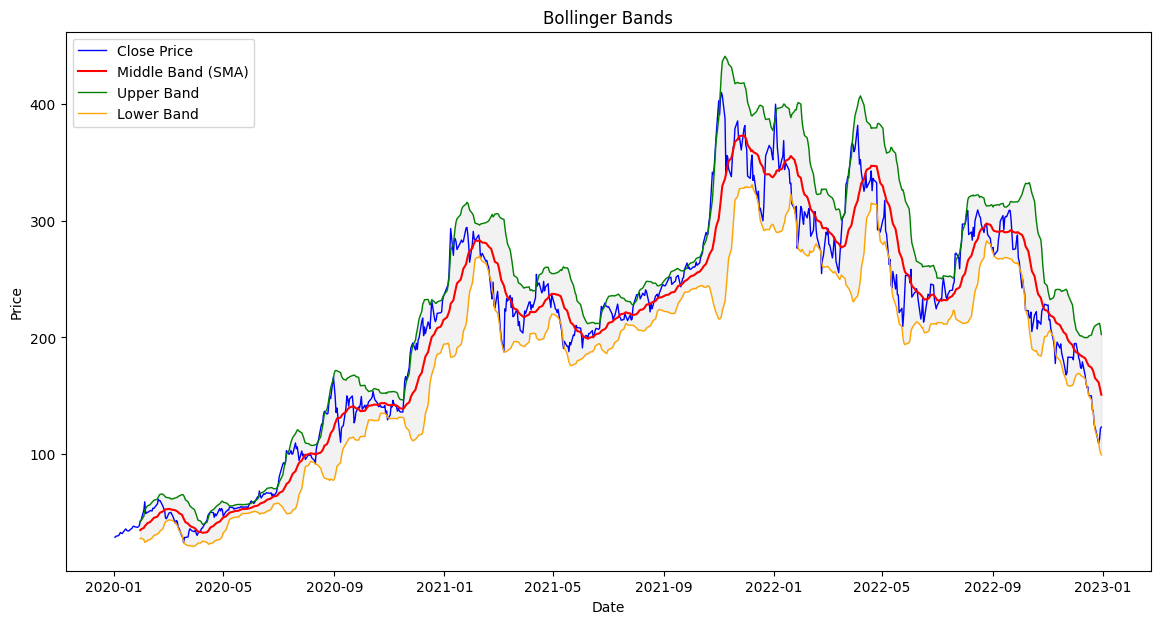

Utilized technical indicators such as moving averages, MACD, and Bollinger Bands to understand stock movement trends and volatility.

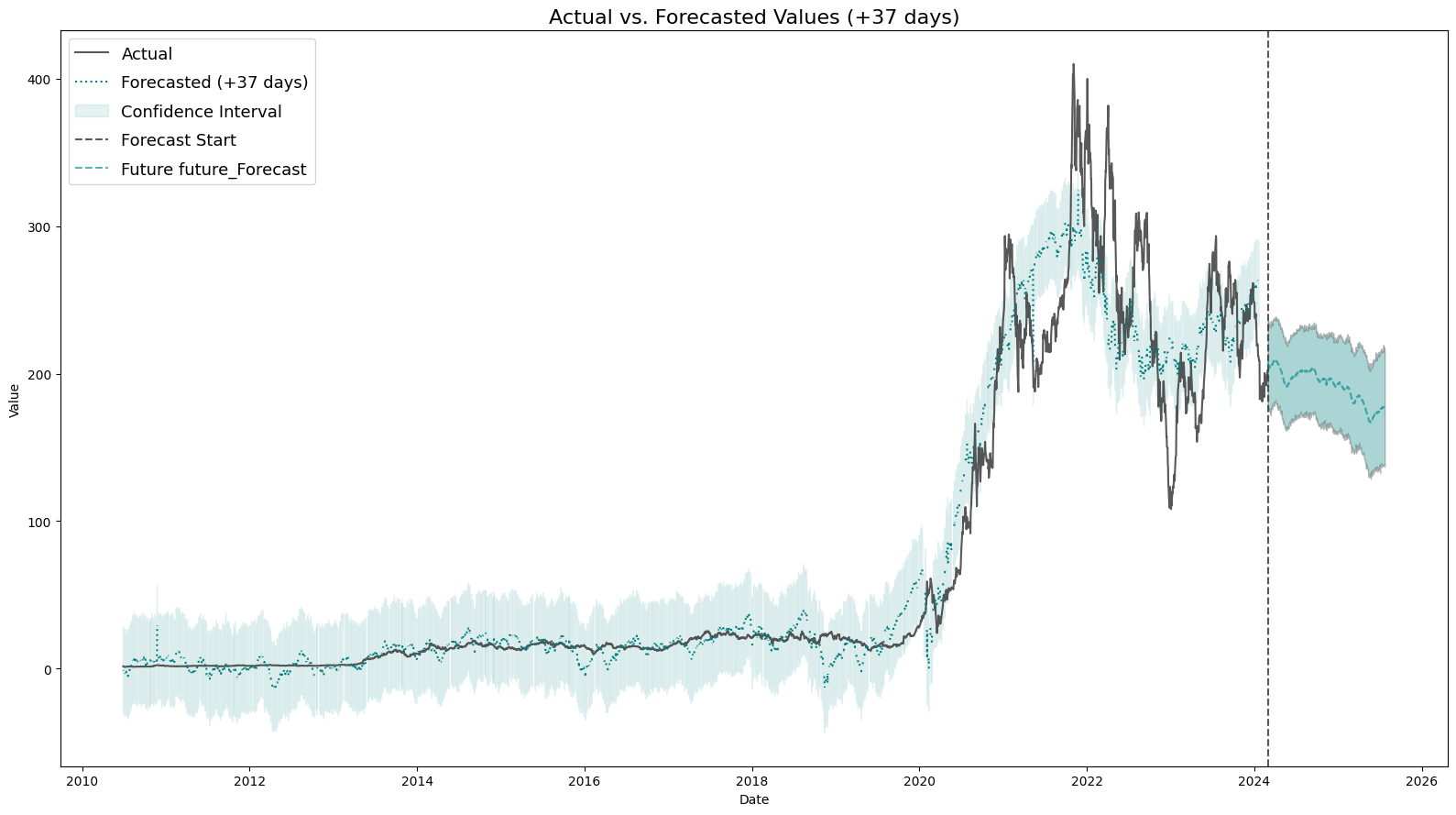

Implemented the Prophet library for future stock price forecasting, incorporating market index data as external regressors.

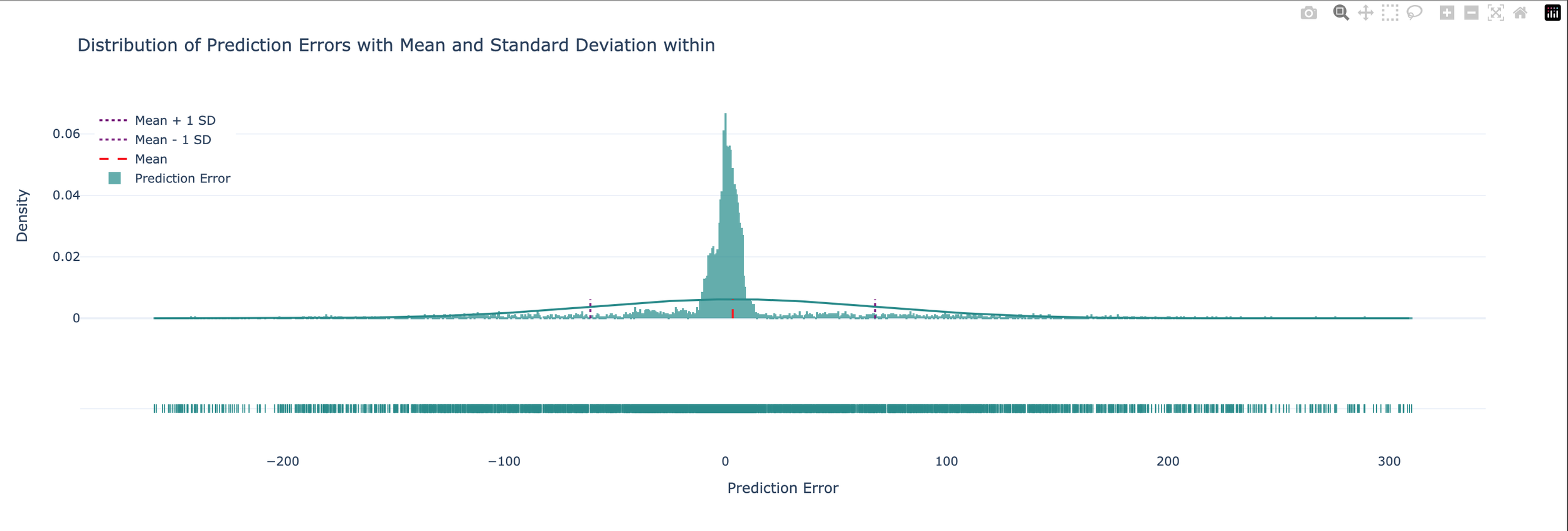

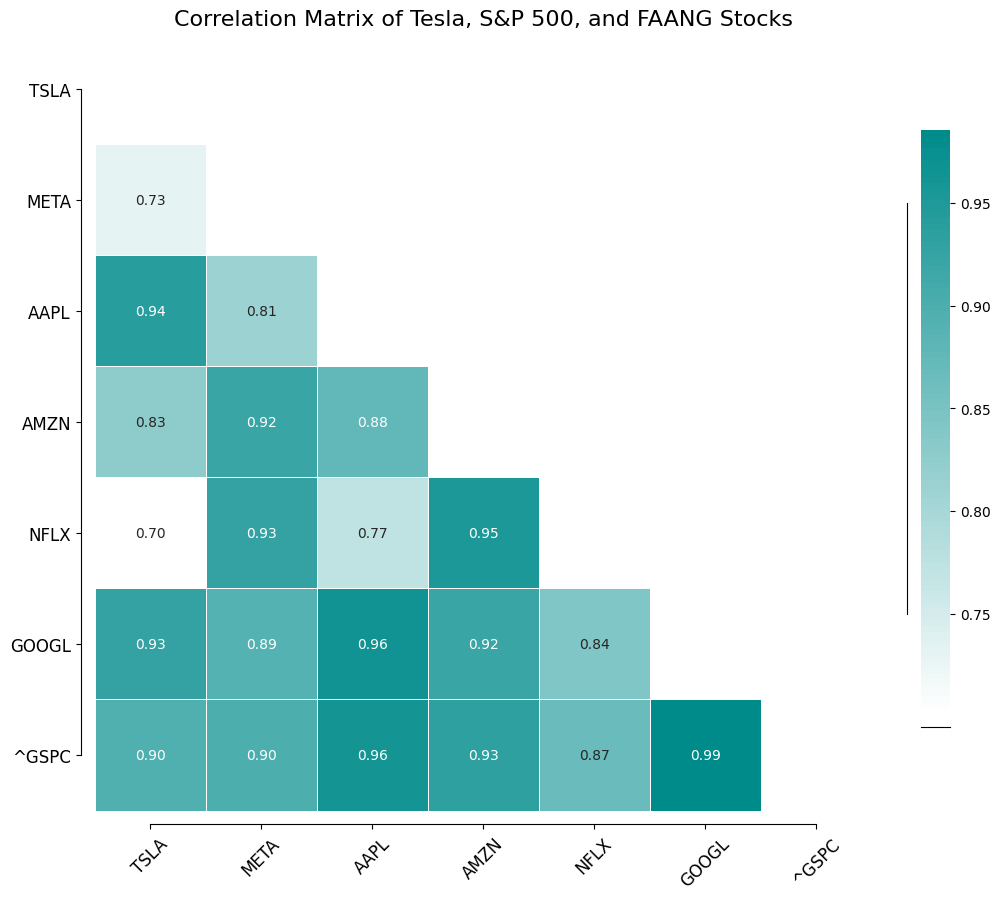

Conducted machine learning analysis with Linear Regression for predictive modeling, aiming to identify correlations between Tesla and FAANG stocks.

In my initial group project at Columbia, we tackled the challenge of predicting stock prices, focusing on Tesla's dynamic market performance. This venture into financial analytics was an exercise in applying machine learning and data science techniques to unveil patterns in stock movements. Utilizing data from Yahoo Finance, we analyzed Tesla against industry benchmarks like GM, FAANG stocks, and the S&P 500, crafting predictive models using Python libraries such as Pandas, NumPy, and Prophet.

The project was a profound learning journey, enhancing my skills in data handling, technical analysis, and predictive modeling. It fostered my abilities in teamwork, project management, and the practical application of ML theories. The visualizations in the gallery and our GitHub repository reflect our analytical depth and collaborative efforts.

Reflecting on this experience, it's clear how much it enriched my understanding of AI and ML's potential in finance, emphasizing the importance of continuous learning and innovation. It signifies my ongoing commitment to leveraging AI for solving complex challenges and marks a pivotal start to my exploration in AI and machine learning.

As you explore the visualizations and GitHub link, consider this project as a testament to my technical acumen and creative approach, highlighting my journey towards mastering AI to address real-world problems.